First off, I would like to congratulate the rest of Regina's media outlets for finally catching up on a story we brought you right here first. It would appear that the Leader Post has finally put a story together about an expected Property Tax Increase for 2014. We here at the Saskatchewan Taxpayers Advocacy Group broke this story nearly a month ago! On a side note, it would appear City Council still doesn't care about the poor or anyone that truly needs affordable accomodations.

Now onto the big story of the evening. Property Tax Breaks. Who should get them? Who shouldn't? What criteria should be used to decide who gets them? Why does it seem it's always big business getting the breaks, and never the people that could really use a break? Why is it okay for the City of Regina to continue to ignore the plight of the common man/woman while they pad their own and their friends' pocketbooks with our money?

On Monday, Regina City Council will vote on whether or not to allow the Regina Trades and Skills Centre a 100% Property Tax Exemption for a full five years. Now, on the surface, this would seem like a great idea! And, well, it is. IF it was applied equally and farily to all. Unfortunately, this does not seem the case.

I certainly plan to address City Council on this issue on Monday, and have submitted my delegation today. I haven't heard back, so that's a good sign that they won't be editing my speech!! Oh, I guess I forgot to mention that the Chair of the Board for the Regina Trades and Skills Centre is none other than Mr. John Hopkins, the CEO for the Regina Chamber of Commerce (who happened to expend a lot of "their" own money - members money - on their own version of the Vote No campaign during the WWTP Referendum). I guess you could suggest this is the return of that favour?

Here you go, exclusively for you dedicated readers: (Don't worry, City Council and Regina Chamber CEO/Regina Trades and Skills Centre Board Chair John Hopkins get a sneak peak at this anyways - so they can prepare their canned answers or speeches for Monday to debunk anything I say)

Good evening Members of City Council and Senior

Administration,

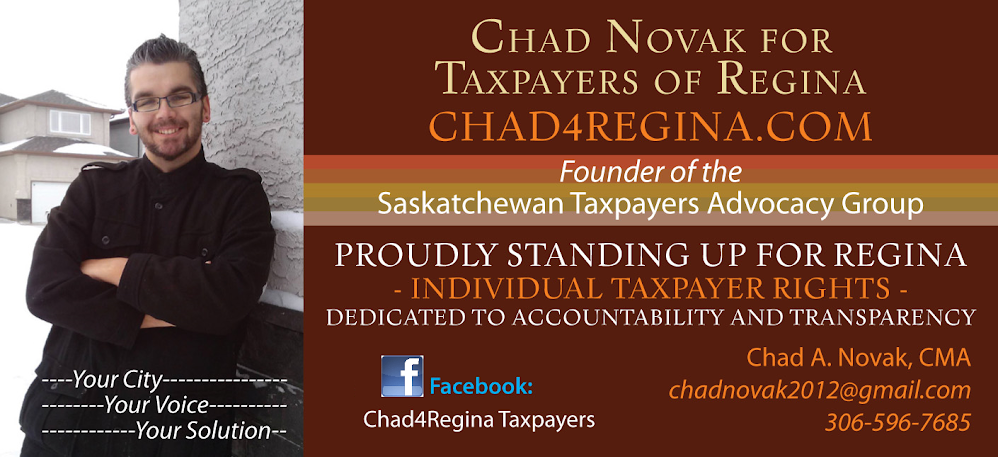

My name is Chad Novak, and I am here today

representing the Saskatchewan Taxpayers

Advocacy Group, a truly grassroots group of individuals from Saskatchewan

that are pushing for Accountability and

Transparency from their municipal governments. You can find more

information about our goals on our website www.chad4regina.com.

I am here to address the recommendation before you today, regarding the requested

Five Year Property Tax Exemption for the Regina

Trades and Skills Centre.

First off, I would like to say that we are

very much in support of providing financial assistance to any agency or

non-profit that is able to provide a valuable community resource that

contributes to our overall social well-being. Without agencies like this, we

are confident that companies would have a much harder time finding the skilled

labour they require to answer to the demand that has been created over the past

few years. However, we do have some serious concerns regarding the fair and equitable treatment of similar

organizations, and we think that we can all agree that the goal of property tax

exemptions help reduce the financial burden on these kinds of organizations.

With that said, I have found through my research that the City of Regina, through the former Regina Regional Economic

Development Agency, has an established policy that is used to ensure that

all such agencies, non-profits and businesses alike, do get the same fair and equitable treatment, in order

to maintain a level playing field for all.

I would like to note that we have a few

concerns regarding this application, specifically, and it is my hope that these

concerns can be addressed to the taxpaying citizens of Regina, before any final

approval is given. I should note, that it is not clear in the application as to

what factors were actually considered when providing the previous tax

exemption, and what factors are being considered for the current tax exemption

request.

My first concern is that of financial necessity. I am quite

confident that most non-profits only continue to exist with as much community

support as possible, and without that support, it would be near impossible for

them to provide the social benefits that they offer. I note that the RTSC receives a substantial amount of

financial assistance from various levels of government funding already, and

this would lead me to wonder, would they have a hard time providing the

training that they do, without this requested Property Tax Exemption? Without

seeing the Financials that are noted as being included in their letter, it is

very difficult for the general public to determine just how essential this requested tax break is to

their continued existence.

Secondly, the policy that is outlined on

the Regina Regional Opportunities

Commission website, specifically states that they are to be the first point of contact for any Property Tax

Exemption requests, and they are to

evaluate each request based on a variety of pre-determined criteria. I note

that this request, along with the previous request from 2011, were not sent to RROC, but directly to your

tax assessor, Don Barr, and to the Finance and Administration Committee

respectively. In this policy, it specifically states that the RROC would handle

requests all the way through to putting a recommendation through to City Council.

I could see this as a mere oversight for an average taxpayer, but given the

close relationship of the RTSC and the City of Regina, one would reasonably

expect this protocol to be very well

known, and thus raises some questions as to the fairness of these requests.

If, in fact, these requests did go

through the RROC, then certainly you shouldn’t have a problem with providing this

information to the general public, including how the RTSC placed on the

evaluation matrix, which determines just how much of a tax

exemption an organization would get, and for how long. Not knowing much more

about the RTSC than what’s in the report and other publications, I did a quick

calculation, and it would seem they score pretty low on the matrix, and at best would be eligible for a 2 year, 25% Property Tax Exemption.

Thirdly, I may have missed it in my

research, but it does not appear that the RTSC actually applied for a renewed

Property Tax Exemption when they relocated to their new facility. Pardon my

ignorance, but I would expect that a Property Tax Exemption be

renewed/reapplied for to the new property, with a different assessment.

Through my research, I did find it quite

interesting that Saskatchewan is the

only province that actually provides their municipalities with the authority to

grant tax exemptions on a case by case basis. To its credit, this does allow

municipalities to set up their own guidelines in order to – in theory – attract more business

investment by offering further incentives to set up shop. Through this same

research, however, I also found that we already are extremely competitive – tax wise – even before any Property Tax Exemption. One certainly has to wonder if

this is even a needed incentive to bring business investment into our currently

booming economy.

We continue to hear about how there is only

so much money that City Hall has to go around, and it would seem that you would

want to maximize every tax dollar you have access to. With that said,

would it not be in the taxpayers best interest to keep a very close eye on what

Property Tax Exemptions are provided, and ensure that the original request

qualifications continue through their given exemption break? We saw what can

happen when you don’t monitor this, in the recent situation surrounding the

District Brewing Company pretty much reconstructing an entire building that was

previously exempted. Unfortunately, the tax exemption was only caught very late

in the process, when they applied for a permit. This is a real concern, and

leads one to wonder how many tax dollars are being “left on the table” with

these exemptions going unmonitored?

Finally, specifically to the parking lot in

the application today, I note that typically Land Ownership is a requirement

nationwide in order to get a tax exemption. It’s even noted in the report

before you today, but I don’t see an explanation as to why the land owner

hasn’t applied for this, and then passed on those savings to the RTSC? I

apologize if I missed it in my review.

Thank you for your time, and I will now welcome any questions

you may have.

No comments:

Post a Comment